Refer to the email from Workday Support Services for a complete list of enhancements.

Business Purpose

The Business Purpose options have been updated. Additionally, users no longer need to choose between official business or non-official business items.

See the Business Purpose table below.

| # | Business Purpose | WD Description | Example Uses |

|---|---|---|---|

| 1 | Conference Attendee | Attending a conference/seminar to receive training or professional development (CI-09) | ASMBR Conference; ACLP Conference; Seminars & Workshops (in-person & virtual) |

| 2 | Conference Host | Sponsoring or hosting a conference, seminar, or training program for other organizations (CI-09) | Official Functions like KidneyCon or Workshops inviting outside attendees (in-person & virtual) |

| 3 | Conference Presenter | Presenter or keynote speaker at a conference or seminar (CI-02) | If presenting at an external conference such as AMBR, ACLP, or others (in- person & virtual) |

| 4 | External Meetings or Events | Attending college fair, recruiting and advancement event, research travel, etc. (CI-02) | Meetings and/or events that are not conferences but are held by outside entities (i.e. a college fair held by Little Rock Central High School, a recruitment event held by the State of Arkansas, a research trip coordinated by Louisiana Tech, etc.) |

| 5 | Internal Meetings or Events | Attending University meeting, internal training event, fieldwork, etc. (CI-02) | Official Functions, meetings held by UAMS for UAMS, site visits to UAMS clinics (for IT purposes, photography shoots, etc.) |

| 6 | Non-Employee Travel | Guest of state, external committee members, candidates, student competition travel, student-athletic event, student- athlete travel, board of visitors etc. (CI-02) | Official Functions featuring guest speakers; student (ECMs) travel; Guest/Recruit travel (ECM ONLY) |

| 7 | Non-Travel | Expense purchases not related to travel (CI-02) | Only for Licenses & Fees, exceptions, or emergencies. Please only use as directed. |

| 8 | Other | (CI-02) | This should be used rarely. Do not use unless requested by Expense Partners. |

| 9 | Recruitment Event – Official | Athletics Recruiting (CI-02) | Not used by UAMS |

| 10 | Recruitment Event – Unofficial | Athletics Recruiting (CI-02) | Not used by UAMS |

| 11 | Vicinity or In-State Mileage | Mileage for local travel, research, errand, etc. Not to be confused with mileage for attending/presenting at a conference, etc. | Courier travel, errands, supply runs, any mileage-only trips not associated with a meeting or event |

- The old Business Purposes will now have “zzz” placed at the front of the name and will remain active for until January 2024 to ensure any ERs/SAs created before 11/21/23 are not interrupted.

- ERs and SAs created after 11/21/23 can only use the new Business Processes.

- State AASIS reporting for business versus non-business items will be done using data from the new Business Processes.

Mileage Expense

Round Trip Mileage

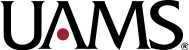

If inputting simple roundtrip mileage, users no longer need to calculate distance. The user will enter exact street addresses in the Origination and Destination fields and Workday will calculate distance using a Google Maps feature. See the screenshot below.

Multiple Trips Mileage

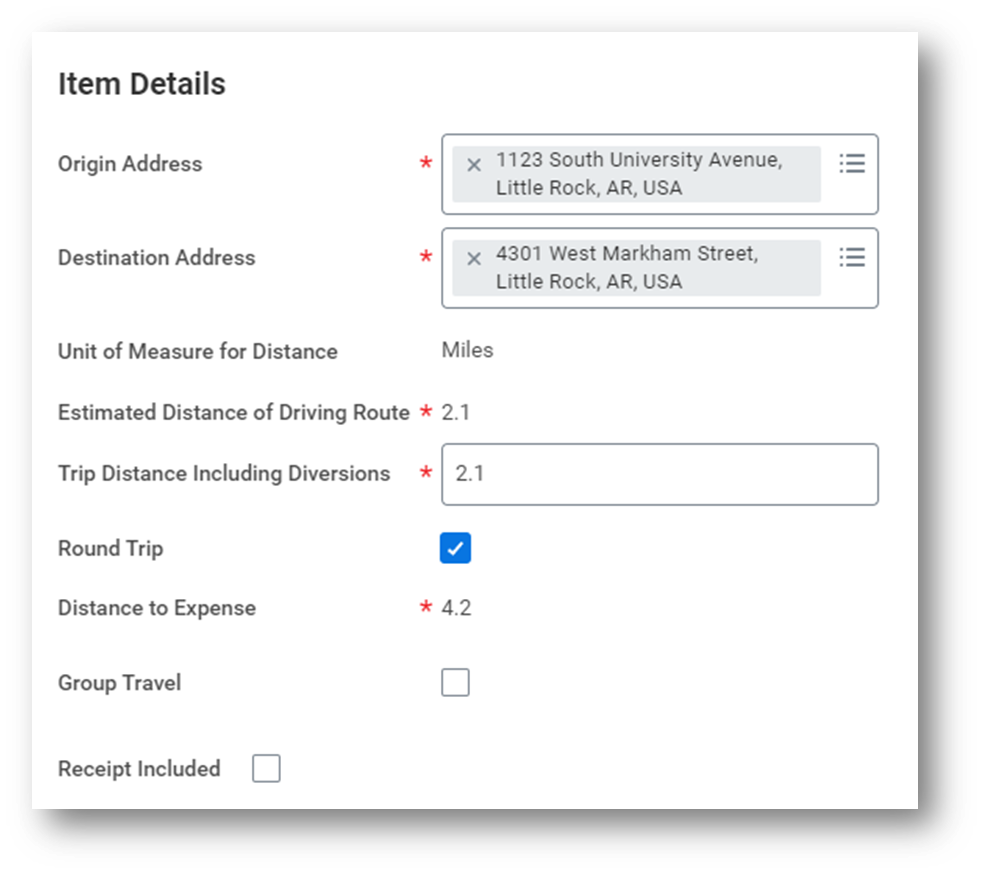

If the user is submitting mileage via a mileage log for more than one trip, the user will need to input the first origination and destination addresses from the mileage log in the appropriate fields and adjust the “Trip Distance Including Diversions.”

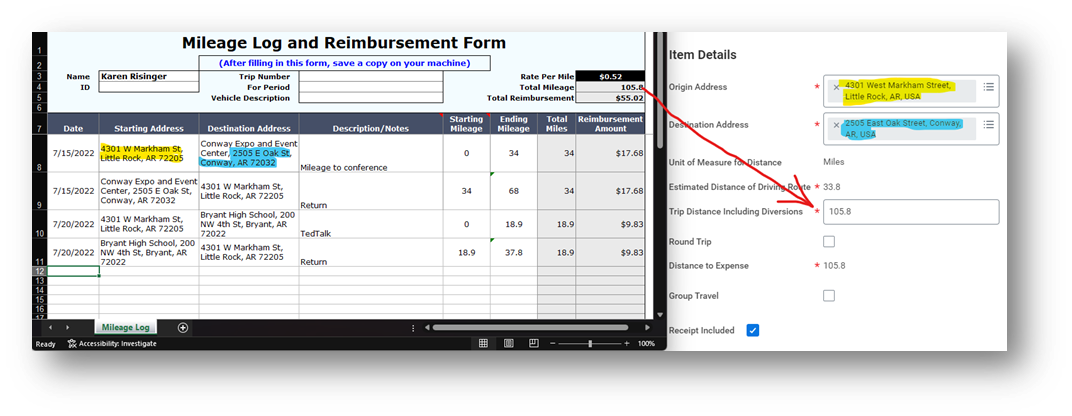

The origin address and destination address must be different. If the amount of Estimated Distance of Driving Route is 0, you will not be able to submit the actual mileage and will receive the error messages shown below.

Fewer Spend Authorization Fields

Arrival and Departure Dates are no longer additional fields for Meal, Hotel, and Flight expense items.

Per Diem Help Tools

There is now a link to a website that will calculate appropriate GSA amounts for hotel and meal expense items.

This will help users with requesting the appropriate amounts for advances/reimbursements.

Merchant Code Mapping

Expense items will now prepopulate on the ER based on the Merchant Category Codes (MCC) from travel card data.

For example, if the Travel Card was used to pay for a flight, previously the user was required to select the Expense Item Airfare – Commercial – Domestic. With the update, Workday will now prepopulate the appropriate expense item for the user.

It is best practice to check the code for accuracy, even when auto/pre-populated by Workday.