Card Holder Responsibilities

Responsible And Permissible Purchases

A cardholder must ensure each purchase they make is a responsible use of funds and permissible by procurement laws and UAMS policies.

🗹 Cardholder must ensure that the good they are purchasing is not

available through:

- One of the purchasing catalogs in Workday

- A current UAMS-vendor agreement

- A preferred vendor

| See Help Page – Utilizing Current Contracts and Agreements for information about items (A), (B), and (C) above. |

🗹 Cardholder must ensure that the good they are purchasing is

permissible per the Arkansas P-Card Manual.

Card Statements And Verification

P-Card statements are issued on the 15th of every month. Some of the cardholder ’s key responsibilities are directly related to the statement, the most important of which is verification. If a transaction is not verified, it will not be expensed to the correct funding source. Delays in transaction verifications can lead to expenses posting to the incorrect fiscal period.

🗹 The cardholder should keep a record of their statements.

🗹 All the transactions on a statement must be verified by the last business

day of the statement month.

❖ For example, every transaction appearing on the January 15 statement must be verified by January 31.

| See the article about P-Cards in Issue 2 of the Procurement Services newsletter for a great explanation of the purpose and meaning of verification. |

| Refer to the Verifying Procurement Card Transactions QRG for step-by-step instructions for completing the verification task in Workday. |

Just like charges, returns (i.e., receiving a credit on your account) must be verified in Workday. Return receipt is uploaded during verification.

❖ Note that return credits may take a few days to appear in Workday.

❖ Reach out to UAMS APO if you do not receive credit for a return within 7 days of the return.

Additional Verification Help

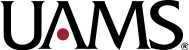

Lose track of a verification task in Draft status?

No problem! You can run a report that returns a list of all your verification tasks, then filter the results to view only those in Draft status.

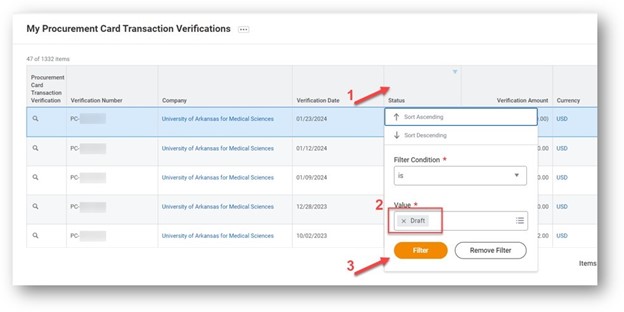

You can then Edit to finish submitting the verification or you can Cancel to delete the verification in draft.

Locating Verification Tasks in Draft Status

- In Workday, enter RPT- My Procurement Card Transactions to run a report.

- Filter the report results using a Value qualifier of Draft.

- Use the related actions button to access the Edit and Cancel options.

Summary of the Verification Task Workflow

Verification Task Workflow

- Purchase goods.

- Gather receipts.

- Complete Verify Procurement Card Transactions task in Workday. Procurement Services recommends completing the verification task the day after using the P-Card.

- Document date: enter the current date

NOTE ABOUT BACKDATING

To expense a transaction to a previous fiscal period, the Document Date may be backdated, but only if the previous fiscal period has not been closed yet. If the fiscal period is closed, you will receive an error and be required to select a new date. - Post date: enter the transaction date as indicated in your account

- Document date: enter the current date

- APO reviews and approves the verification.

- The funding source for each transaction is debited when the verification task is approved.

- The P-card statement is paid by the Treasurer’s Office on the last day of the month.

(Cardholder Responsibilities Continued)

Documentation

Another cardholder responsibility is documentation. As with purchases made using a Requisition, purchases made with a P-Card must be accompanied by supporting documentation.

🗹 The cardholder must provide a receipt for every transaction. The receipt is uploaded during verification.

❖ Scanned images and/or pictures of paper receipts must be clear.

❖ Screenshots of electronic receipts are not acceptable.

🗹 The cardholder must provide additional documentation when required.

See the Section Using a P-Card for Official Functions, Memberships.

Monitoring Card Activity

As explained in the How P-Cards Work section, card activity data is transferred from Bank of America to Workday. The cardholder is responsible for monitoring card activity for accuracy.

🗹 The cardholder must ensure all transactions correctly made their way into Workday. Procurement Services recommends comparing your Bank Of

America (BOA) statement to your transactions in Workday. This comparison

task is easy using a report available through Workday. See the Workday Report to Support the Cardholder instructions below.

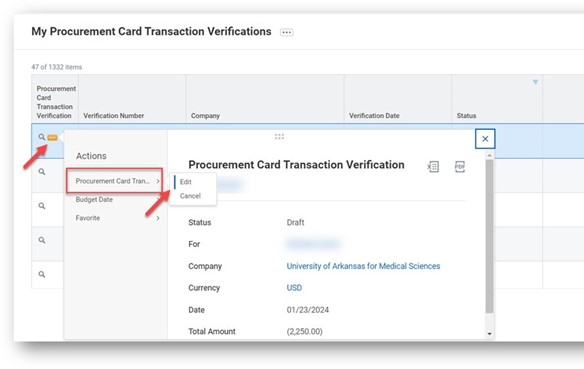

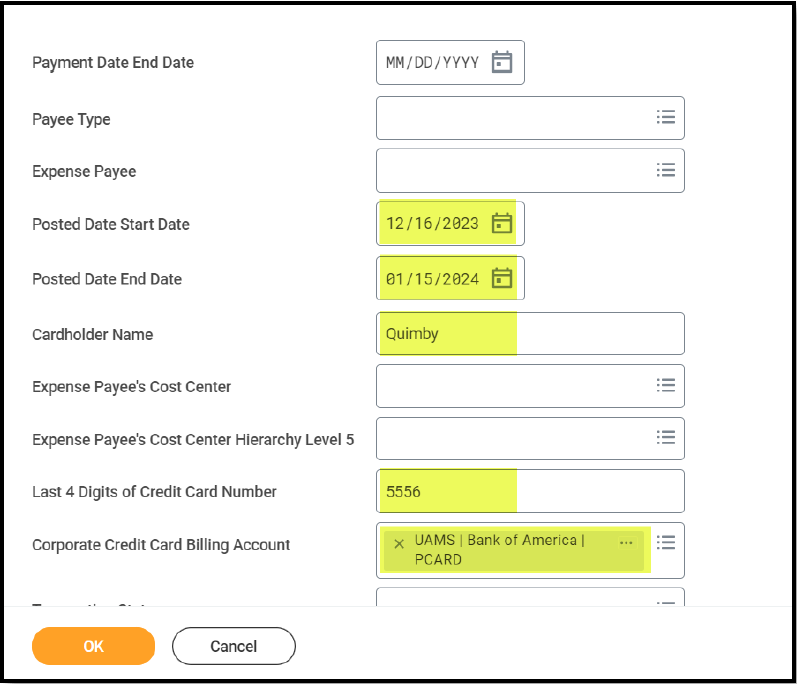

Workday Report to Support the Cardholder

- In Workday, enter RPT – Find Credit Card Transactions to enter desired report details.

- Clear the dates that auto-populate in the Transaction Date fields.

- Enter the BOA statement Start and End dates in the Posted Date fields.

- Enter your last name in the Cardholder Name field.

- Enter the last four numbers of your P-Card in the Last 4 Digits of Credit Card Number field.

- Select UAMS PCARD from the Corporate Credit Card Billing Account field.

- Click OK to run the report.

- Compare the report transactions to the BOA statement transactions to ensure alignment.